- #Reimbursing contractor expenses how to

- #Reimbursing contractor expenses professional

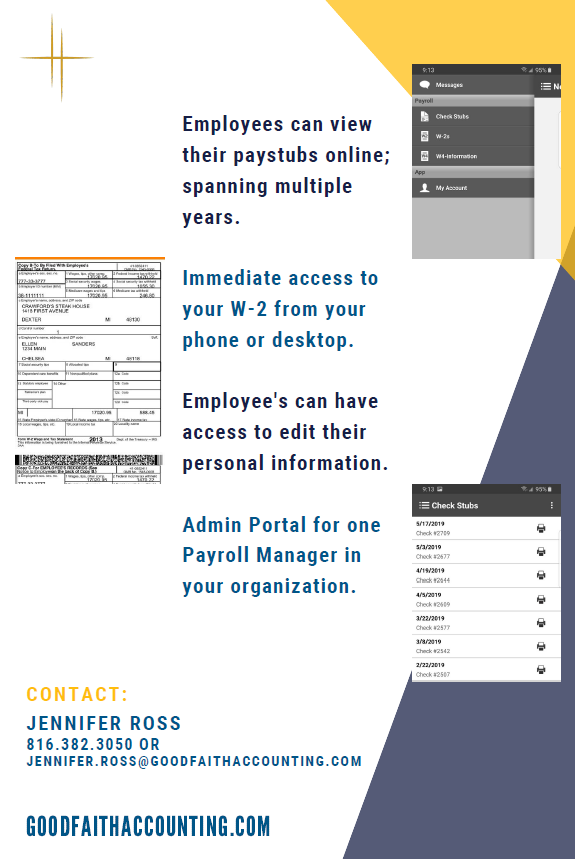

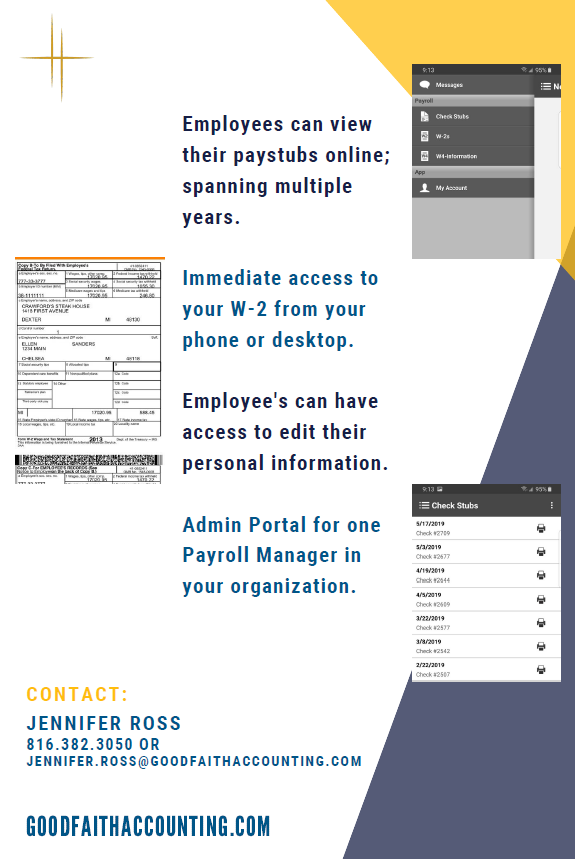

Work with the HR experts at Resourcing Edge to help you create accountable reimbursement policies and add them to the employee handbook.įor employees to submit expenses.

Creating an Accountable Expense Reimbursement Policy for The contractor can then deduct business expenses on their own tax return. Most businesses prefer to include reimbursement amounts in the 1099 income rather than go through reimbursing expenses.

There are different expense reimbursement rules for independent contractors, who are paid via Form 1099. Expense Reimbursement for Independent Contractors To an employee regardless of whether they expect the employee to have

The employer advances or pays an amount. Return excess reimbursements or allowances in a reasonable amount of time. Properly substantiate expenses in a reasonable amount of time. Treated as supplemental wages and subject to taxes. On the employee’s Form W-2 and deductible by the employer as employeeĪ nonaccountable plan, any reimbursement or other allowance arrangement is Wages subject to income, social security, Medicare, and FUTA taxes. They are deductible by theĪny of these conditions are not met, the reimbursements are treated as paid underĪ nonaccountable plan, which are considered wages, treated as supplemental Income, social security, Medicare, and FUTA taxes. Reimbursements or allowances must be returned within a reasonable time (120 days).Īccountable plan amounts aren’t considered wages, they aren’t subject to Return unsubstantiated amounts: Any excess. With substantiation (date, place, amount, purpose) made within a reasonable Substantiate expenses: There must be accounting. Necessary business expenses must have been paid or incurred while performing Order to qualify for an accountable plan, the employer’s reimbursement orĪllowance arrangement must follow all three of these rules: New Tax Cut and Jobs Act, effective for 2018 through 2025 tax years. Should re-examine their reimbursement and allowance policies in light of the According to the IRS, employees must now include moving expense reimbursements in employees’ wages, except for certain members of the Armed Forces. As a result of the Tax Cuts and Jobs Act of 2017, you can no longer reimburse employees’ moving expenses. If you haven’t revisited your employee expense reimbursement policies recently, some business expenses may no longer qualify for an accountable plan. The IRS has different reporting requirementsĭepending on whether you have an accountable or nonaccountable plan. Payment, but what about reimbursements? It depends on what plan you use:Īccountable or nonaccountable. When you pay an employee, you will need to withhold and contribute taxes on the See IRS Publication 535 to learn more about business expenses. It’s important to know which business expenses are valid or not, and to separate business expenses from personal expenses, capital expenses, and expenses to figure the cost of goods sold. They will need to be reimbursed for meals, gas, lodging, entertaining clients, and more. Reimbursements are most common when employees travel for work. Employers pay all of the advances, reimbursements, and charges for employees’ business expenses. When an employee spends his or her own money on “ordinary and necessary” business expenses, a reimbursement or allowance arrangement is the system used to pay them back. What is an employee expense reimbursement? #Reimbursing contractor expenses professional

Work with a Professional Employer Organization such as Resourcing Edge to ensure compliance with applicable laws and develop an accountable expense plan to help maximize tax benefits. Whether or not you pay taxes on expense reimbursements depends on whether you use an accountable plan or nonaccountable plan. Illinois, for example, requires employers to reimburse employees for all “necessary expenditures … incurred by the employee within the employee’s scope of employment and directly related to services performed by the employer.” Be aware, however, that some states have their own laws surrounding expense reimbursement.

While expense reimbursement is only required if it is stipulated in an employment contract or if the business expenses bring the employee’s wages below minimum wage, most businesses reimburse work-related expenses incurred by employees as a job perk.

#Reimbursing contractor expenses how to

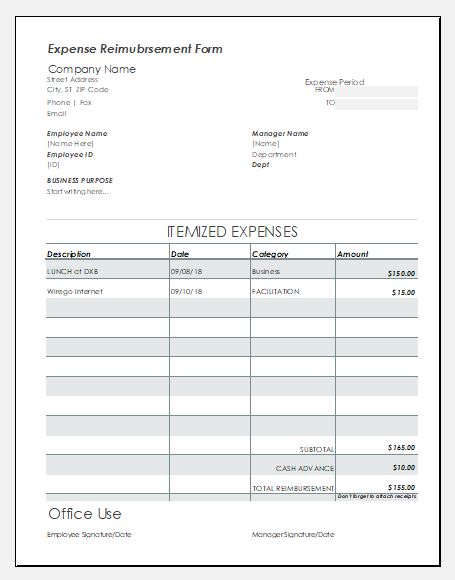

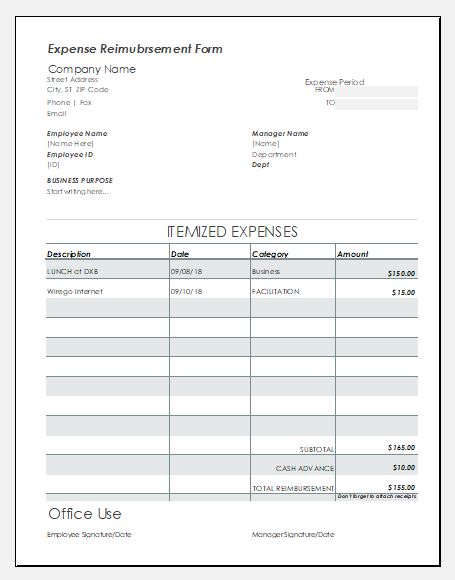

Involved, such as compliance issues and how to report the reimbursements on Seems simple enough - an employee pays for a business expense out of pocket, and

0 kommentar(er)

0 kommentar(er)